Category: financial planning retirement

Why An Estate Plan Is Essential For Investors

A new President brings new priorities and a new fiscal plan to fund those priorities. Consequently, there has been much discussion this year of potential impacts to income and estate taxes. Despite a lot of conversation and preliminary proposals, we still lack clarity on what changes may ultimately...

Why You Shouldn’t Leave Family Property to Your Children

I’ve had numerous clients leave family homes—from beach houses to picturesque farms—to their children as part of their estate plans. However, despite the best of intentions, this decision isn’t always in the best interests of the heirs. The reality is that inheriting a family home can be more of a...

Why an Estate Plan Is the Best Gift You Can Give Your Grandchild

While awaiting the recent birth of my first granddaughter, I spent a lot of time thinking about the best possible gift I could give her. Ultimately, I decided that the ideal present for my grandchild was to give her parents–my daughter and her husband–a professionally drafted estate plan.

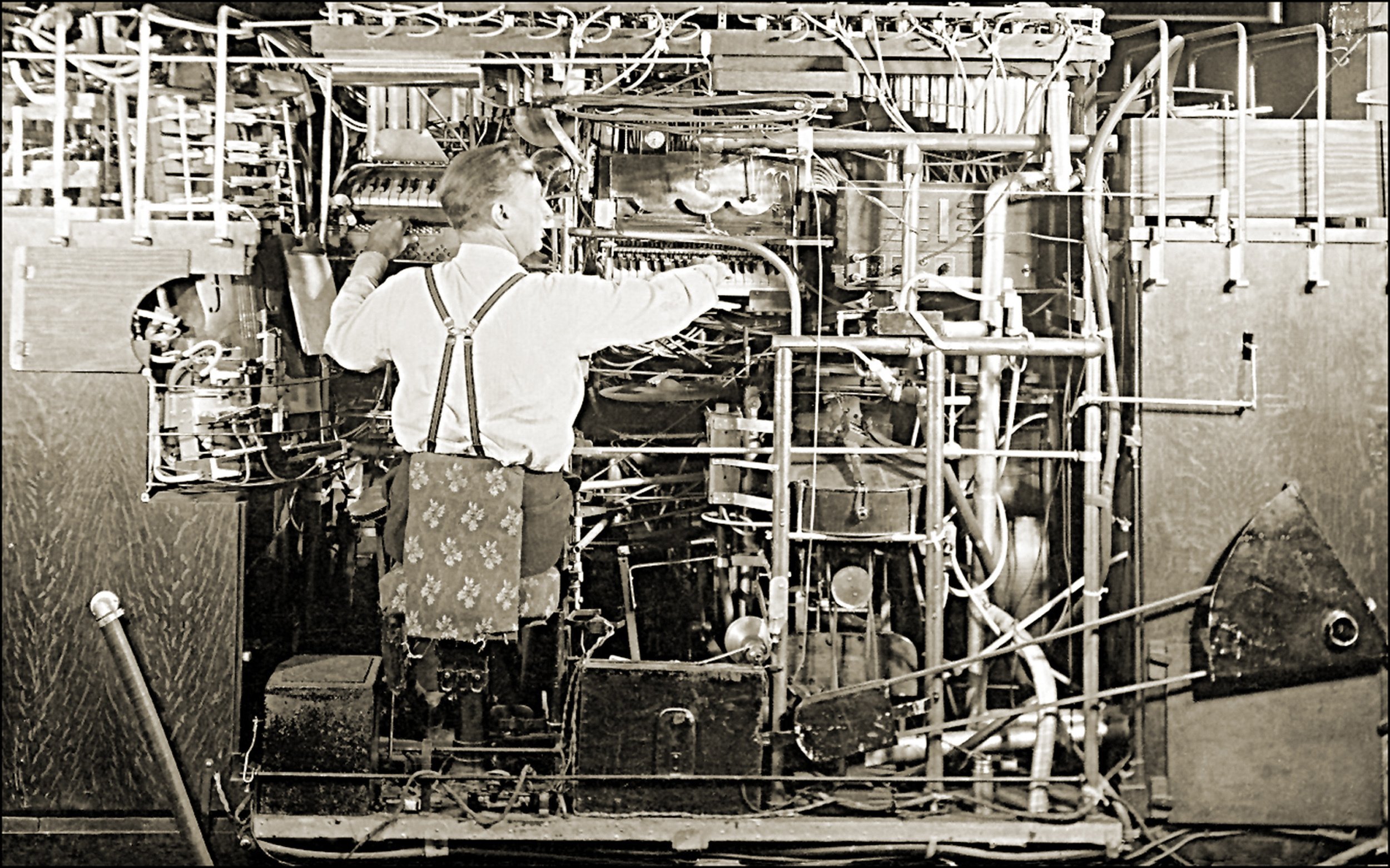

The History of Retirement

For many Americans, building the financial assets to transition from daily work to retirement later in life stands apart as a top goal. The concept of retirement is deeply ingrained in today’s culture, but it’s actually a relatively new idea. In 1900, the average global life expectancy was just 31...

Strategic Ways to Optimize Financial Planning in 2021

As 2021 gets underway, there’s a palpable sense of optimism both domestically and internationally as we move forward with an expanded rollout of the COVID-19 vaccine. We hope the New Year will bring an increased demand for travel, dining, and entertainment that will give the private sector a...

Planning Throughout the Retirement Lifecycle

We generally think about retirement in three broad phases. Within each phase, distinct trends and priorities have emerged among retirees in the numerous studies that have been completed on the topic. Each client has their own unique plans for retirement, but understanding these general patterns...

The Election Is Over. Now What?

Election Day 2020 has come and gone, and many clients are naturally interested in what the results mean for their personal finances. Although President-elect Joseph Biden’s policy agenda offers stark contrasts to many current policies, particularly in the realm of tax policy, the degree to which...

Preventing the Need for Early Retirement Account Withdrawals

Over the past several months, 401(k) plan participants have asked about taking advantage of pandemic-related CARES Act changes to retirement account withdrawals. Although the CARES ACT has made it easier to withdraw funds, this should only be done as a last resort. Steps can be taken to prevent the...

How to Determine Your Ideal 401(k) Asset Allocation

There are three major factors that impact your retirement goals: how much money you save, how long you save, and the rate of return on those savings. Quite often, investors focus on their short-term rate of return, which is the factor over which they typically have the least control. In fact,...

How to Keep Heirs From Being Spendthrifts

This article was originally published to subscribers of The Wall Street Journal, found HERE.