Category: financial planning retirement

A Rational Approach to Market Volatility

Through the first nine months of the year, it looked like 2018 would be another pleasant year for investors. The S&P 500 climbed more than 7% in the third quarter, pushing the year to date return for the index above 10%. But those gains – and then some – evaporated in the fourth quarter, with the...

A Financial Planning Christmas Carol

Maybe it’s the holiday season, but financial planning makes me think of Charles Dickens’s A Christmas Carol. Remember how Ebenezer Scrooge was visited by 3 ghosts—Christmas Past, Christmas Present, and Christmas Future? It gave him the opportunity to witness, from a reality-ringside seat, a view of...

The Countdown to Retirement: 7 Smart Ways to Get Ready

Most people become even more focused on planning and saving as they near retirement age. The most common questions we hear people ask is, “Will I have enough money?” followed closely by, “When can I retire?” But what about high earners who know they’ll have enough money for their golden years? Is...

The 9 Must-Have Tips for Picking a New 401(k) Plan

Are you unhappy with your existing 401(k) provider and want a better option for your employees? Perhaps you’re wondering if there are better investment options out there — or if your 401(k) fees are too high. Maybe you’ve even found yourself dealing with the fallout from a poorly administered plan,...

Planning for the Trip of a Lifetime

I recently traveled abroad and while I was preparing for the trip, I tried to anticipate the problems that travelers might encounter. Properly preparing for a trip means planning for contingencies and emergencies. We made sure to double and triple check that we had the necessary clothing, our...

Life Insurance–Too Little or Too Much?

Life insurance is a risk management tool for both personal and business risks. In the event of the premature death of an income earner or parent, life insurance can provide tax-free cash to cover immediate expenses as well as ongoing financial support for the family.

Managing Financially After Losing A Spouse

Grappling with the loss of a loved one is the most difficult time in one’s life. Often, after years of working with an affluent couple, we find ourselves guiding the surviving spouse through the financial aspects of this major life change. Generally, it’s the husband who passes first, so quite...

From Our Family to Yours: 4 Ways to Teach Kids About Money

Teaching kids about money in the Digital Age isn’t always easy. Between online shopping, direct-deposit paychecks and banking by app, today’s children are growing up in a world where they may rarely experience a cash purchase or even a monetary transaction. To kids, it can look like the next item...

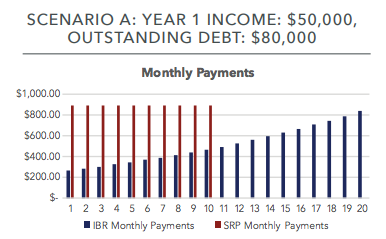

The Graduates’ Trillion Dollar Problem

Over the past few decades, student debt has transformed from a tool for accessing higher education to a significant obstacle preventing young people from accumulating wealth and saving towards retirement. According to a February 2017 report published by the Federal Reserve Bank of New York,...

An Asset Manager Embraces Financial Planning

I have been investing other people’s money for over 36 years. As most of my clients are either saving for retirement or living off of their retirement savings and/or trust accounts, my overriding goal has been to build durable, income-producing portfolios that will enable my clients to live off of...