CONSERVE. PLAN. GROW.®

When I meet with 401(k) participants to educate them about saving and investing, I always start with the basics—explaining, among other things, what stocks, bonds, and mutual funds are, and how and when they might be utilized in an investment portfolio. Because participants seem to find this information helpful, I thought it might be beneficial to share some of these basics with a broader audience. Although the focus of this article is mutual funds, in order to understand mutual funds, we first must address what mutual funds mostly hold—stocks and bonds.

Stocks represent shares of ownership in a public company. The market value of stocks (also called “equities”) is largely determined by the success or earnings potential of the company, which can be influenced by many factors in the economy as well as in a particular industry or company. Investors can earn money on stocks through dividends (money paid out from company profits) and growth in the company value (increases in stock price).

Historically, stocks as an asset class have provided higher annualized returns over the long-term than other types of investments, but they also have a higher level of risk. Price movement can be unpredictable and can fluctuate widely (this is why stocks have higher volatility than other asset classes). Over the long term, stocks as a whole have delivered annualized returns (average annual returns) in the range of 8-10%.

Bonds are essentially loans investors make to others, whether to a government or a corporation. The borrower pays to the investor fixed interest payments over a specified period of time (hence the alternative name for bonds of “fixed income”), and pays back the principal at maturity. Three major categories of bonds are Treasury (issued and guaranteed by the U.S. Government), Municipal (issued by local and state municipalities), and Corporate. The price of bonds may fluctuate due to changes in interest rates and the credit quality of the issuer. Certain types of bonds may carry more credit risk (typically the higher the risk, the higher the required rate of return).

Though the value of bonds does not fluctuate as widely as those of stocks (thus lower volatility), bonds historically have had lower annualized returns over the long term than stocks. Over the long term, bonds as a whole have delivered annualized returns in the range of 4-6%.

An open-end mutual fund is a publically-traded, dailyvalued investment vehicle that pools the money of many investors for the purpose of investing in stocks, bonds, and other asset classes. Mutual funds are managed by a team of investment professionals who select investments in various asset categories according to a defined investment objective. In essence, when we invest in a mutual fund we are delegating to a professional investment manager the responsibility for selecting individual securities (stocks and bonds) within a defined asset category (or categories) and in line with a defined investment strategy. A fund prospectus describes the fund’s investment objective, investment approach, and permitted investments.

Mutual funds can be advantageous in portfolios because they allow investors to invest in a diversified portfolio of many individual stocks and/or bonds—positions the investor might not be able to achieve through purchasing individual securities—in a cost-efficient way. For this reason, mutual funds are frequently used in 401(k) plans and investment accounts. Even in high-net worth accounts which contain individually selected equities and bonds for the major asset categories such as large cap stocks and corporate bonds, mutual funds can be useful to gain broad exposure in other market segments (mid-cap, small-cap,international, emerging stocks for example) and non-correlating strategies (alternatives and global bonds for instance).

Mutual funds can be either passively or actively managed. A passive mutual fund manager generally invests in all the stocks or bonds tracked by a particular index. For example, a large cap index manager may buy all 500 of the stocks in the S&P 500 index. The fund manager’s objective is to mirror the performance of a given index (hence the name “index funds”).

An active fund manager, on the other hand, makes selections of stocks or bonds within a given index or combination of indices, and tries to deliver better returns than the index by pursuing a defined strategy. Actively managed funds typically have a higher expense ratio than passively managed funds because active management requires a research team, ongoing fundamental analyses of individual securities, and skillful decision making and judgment on which securities to buy, hold, and sell.

Both index and actively-managed funds have their merits. Active management is useful if the fund manager is able to deliver—on a consistent long-term basis—net-of-fee returns in excess of the benchmark. Identifying the “best in class” managers in each asset category takes a lot of quantitative and qualitative due diligence as well as access to data, analytical skills, and research tools that individual investors may lack. If investors do not have a fiduciary investment manager (one who works solely on their behalf and in their best interests) selecting, monitoring, and replacing fund managers for them, they are probably better served by investing in low-cost index funds.

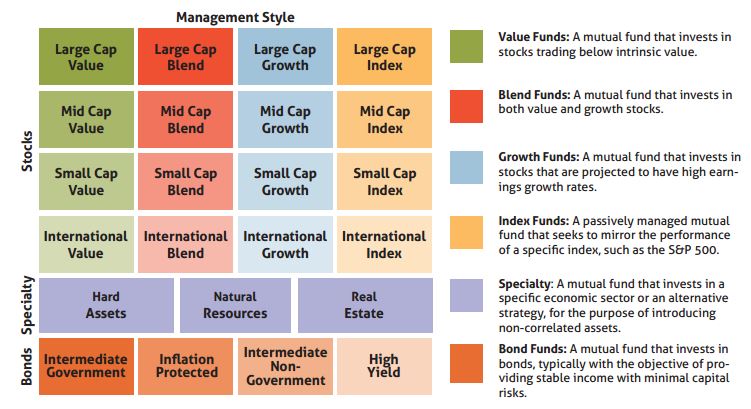

Funds are typically characterized by the asset type into which they fall, with the two largest overall categories being stocks and bonds. Sub-categories of stock funds will include different types of investment styles (value, growth, blend, or index), market capitalization (large, mid, and small), and geographic focus (U.S., international, and emerging), as well as specialty categories such as hard assets and real estate. Bond categories will include government, corporate, high-yield, and inflation protected bond funds. Here is a grid that provides a helpful overview of the major categories of stock and bond funds:

There are a number of rating systems which attempt to identify which funds outperform their peers. One of the most commonly used is Morningstar’s “star” rating system. Morningstar rates funds from 1 to 5 stars, with 3 being “average” which simply means that the fund has achieved “average” risk-adjusted returns relative to its peers in that asset category. One would expect most index funds to receive a 3-star rating because index funds, by their nature, are intended to track the index rather than outperform it. Because some index funds have very low operating expenses, they sometimes achieve a 4 star rating.

If an investor is going to utilize an actively-managed fund (and pay higher expenses than for an index fund), at a minimum the investor should look for funds that have a minimum of a 4 or 5 star rating (and certainly should avoid funds with a 1 or 2 star rating). A 4 or 5 star rating indicates that the fund manager has achieved “above-average” risk-adjusted returns relative to its peers. About 10% of all funds receive a 5 star rating and 22.5% a 4 star rating.

Even after identifying the 4 and 5 star candidates in a particular asset category, additional quantitative and qualitative due diligence is required to select the optimal fund manager. The 4 or 5 star rating indicates outperformance relative to peers. However, it is important to identify those managers who not only consistently outperform peers, but who also consistently outperform the relevant benchmark (index). After that, it’s important to identify the managers within that group who have outperformed the index without taking excessive risk (as measured by standard deviation). Additionally it’s important to get to know the fund manager and to understand the firm’s culture, investment processes, and strategies. Fund expenses also need to be taken into consideration. This qualitative and quantitative due diligence should be part of the process that an effective fiduciary investment advisor follows in selecting, monitoring, and replacing funds on an investor’s behalf.

Every investor should understand what expenses they are paying. Different share “classes” of the same mutual fund carry different expenses. Funds with front-end or back-end load fees should be avoided (these are sales commissions paid to a broker or financial advisor). Investors should seek funds with reasonable operating expenses (Morningstar provides comparative expense analyses on its web site). Included within operating expenses may be 12(b)1 fees which typically are paid to a broker or financial advisor (and which may influence his/her decision to recommend that fund or fund family). Fiduciary advisors do not receive sales commissions or 12(b)1 fees from funds because that would be a conflict of interest (fiduciary advisors are paid only by the client and must act solely in the best interest of the client; fiduciary advisors should not receive financial incentives related to his/her recommendations). Although expenses are an element to consider, it’s not the only factor. Performance is reported net-of-fees and if a manager consistently outperforms the benchmark even after the expenses are deducted, the higher expenses may be worth it.

Every investor should understand what expenses they are paying. Different share “classes” of the same mutual fund carry different expenses. Funds with front-end or back-end load fees should be avoided (these are sales commissions paid to a broker or financial advisor). Investors should seek funds with reasonable operating expenses (Morningstar provides comparative expense analyses on its web site). Included within operating expenses may be 12(b)1 fees which typically are paid to a broker or financial advisor (and which may influence his/her decision to recommend that fund or fund family). Like us here at The Fiduciary Group, Fiduciary advisors do not receive sales commissions or 12(b)1 fees from funds because that would be a conflict of interest (fiduciary advisors are paid only by the client and must act solely in the best interest of the client; fiduciary advisors should not receive financial incentives related to his/her recommendations). Although expenses are an element to consider, it’s not the only factor. Performance is reported net-of-fees and if a manager consistently outperforms the benchmark even after the expenses are deducted, the higher expenses may be worth it.