CONSERVE. PLAN. GROW.®

The Election Is Over. Now What?

November 25, 2020

Election Day 2020 has come and gone, and many clients are naturally interested in what the results mean for their personal finances. Although President-elect Joseph Biden’s policy agenda offers stark contrasts to many current policies, particularly in the realm of tax policy, the degree to which the political consensus will push through sweeping changes remains an open question, given the outsized impact of the two Georgia special election Senate races in January.

Beyond this more granular focus on potential policy impacts, however, it’s instructive to take a step back and look at the big picture when assessing the potential impact of the recent election results — both on markets and on various planning strategies. When we look at the effect that various political parties have had on markets over the years, the impact is less than you might think.

Financial Markets

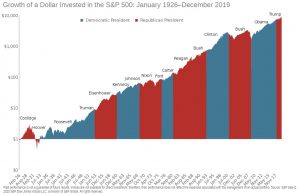

In the chart, we see various presidential tenures highlighted alongside the performance of the S&P 500 since 1926. We are reminded that the long-term trend of the S&P 500 has been up, and that upward long-term trend has persisted over the course of both Republican and Democratic governments. Likewise, we can also find periods of market softness under both Republican and Democratic tenures. The American economy has proved to be quite durable over the long term, and the best companies have been able to adjust over time to perform in a variety of political environments. Importantly, we must also remember that the political environment is just one of many factors which influence the economy and markets.

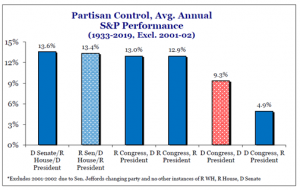

The graphic measures the performance of the S&P 500 since 1933 and organizes the return according to the years in which political parties were in control of the White House and Congress. In four of the six combinations measured, the average annual returns are actually within a single percentage point of one another. The data in this graphic covers a long period of time and includes several combinations of political party control.

When we look back to more recent history, just four years ago, we are reminded that there were plenty of pundits who forecasted various policy changes and made assertions about the far-reaching impacts they would have. One example was the prediction that Obamacare would meet its quick demise after President Trump was inaugurated and that the healthcare industry would soon be upended as a result. This change never came to fruition, and the Obamacare healthcare system continues to operate today.

In today’s headlines, it is easy to find a multitude of new predictions about various sectors of the economy that will either benefit from or be punished by a Biden presidency. The healthcare industry today is again one these sectors discussed. The larger point is not that the Obamacare prediction turned out to be wrong, but a more prudent investment strategy is to focus on building a high-quality portfolio that can perform well in a variety of political and economic environments.

Planning Strategies

One phrase in the financial planning world we often repeat is that the day after we complete a financial plan is the day it becomes outdated. Laws and regulations, as well as life circumstances and family dynamics, are always changing. Planning strategies should also adjust over time to incorporate both factors.

Campaign trail proposals from Biden included several important changes that would meaningfully impact planning strategies. Specifically, President-elect Biden has suggested a number of significant tax changes, with wide ranging implications on areas including income tax, retirement savings deductions, the tax deduction for pass-through business owners, capital gains and dividend tax treatment, a 50% reduction in the estate tax exclusion amount, and the elimination of the step-up in basis rules for inherited wealth. Ultimately, Biden is not able to make these changes alone, and party control of Congress will be a crucial factor in determining the viability of these campaign trail proposals being signed into law. Given that the two January runoff elections in Georgia will determine control of the U.S. Senate, we will have to wait until 2021 to better understand the viability of these proposals.

Without clarity on any potential policy changes before year end, clients still have plenty of opportunities to revisit planning considerations. The CARES Act passed earlier this year and the SECURE Act passed in late 2019 both afford clients with new legislation to incorporate into planning decisions.

Clients with qualified retirement accounts subject to Required Minimum Distributions have a “holiday” from this requirement in 2020. Qualified Charitable Distributions from a retirement account are still allowed for 2020, and so an IRA can still be used as a viable vehicle for charitable giving.

However, volatile markets this year mean that clients may have some positions with gains and so

me with losses. Using assets that have declined in value in traditional IRAs may be attractive to use for a Roth IRA Conversion strategy, in which clients transfer funds from a traditional IRA to a Roth IRA. This strategy means clients pay tax now on converted dollars, allowing those assets to appreciate in a Roth IRA. This provides greater distribution flexibility during the account owner’s lifetime and can be a friendly wealth transfer vehicle. Assets that have significantly appreciated in value can be good candidates to use for charitable contributions. Interest rates have fallen this year, so it may be a good time to revisit credit strategies.

Each family’s situation is different, and the planning process starts with an evaluation of your unique goals, needs, and concerns. Planning decisions should reflect your own goals and values, and take advantage of the current legal, tax, and market environments.

If our team can be helpful in planning for 2021 and beyond, please reach out to us for assistance. We’re here to help.