CONSERVE. PLAN. GROW.®

Taking Financial Wellness from Good to Great!

March 28, 2019

I’ve had the pleasure recently of working on financial planning with three young couples, one in their early 30’s, one in their early 40’s, and one in their early 50’s. They are all high-income earners and have managed their finances responsibly. They save regularly to their respective 401(k) plans, live comfortably within their means, are on track to be debt-free by retirement, and have set realistic financial goals. So you may be wondering, why would they want or need to work with a financial planner?

My answer is, to take their financial wellness from good to great! It’s no different than the motivation you may have to work with a personal trainer on your physical fitness. You don’t have to wait until you’re totally out of shape and unhealthy before seeking a trainer or coach. Even if you’re in good physical shape, you can choose to work with a trainer to become stronger, toner, more flexible, and better able to navigate the effects of aging, health issues, or accidents. Working with a financial coach is similar. You may be doing well financially but want to take your financial well-being to a higher level—and, just as with physical fitness, you can continually monitor and improve your condition so that you not only stay financially fit but continue to grow stronger over time.

Financial planning gives you peace of mind and confidence that you are on track to live the lifestyle you want and accomplish the goals that are important to you. This could include enjoying a fulfilling financially stress-free retirement, putting your kids or grandkids through college, extensive travel, charitable gifts, or another goal that is meaningful to you.

What does the planning process look like?

Step 1: Capture and Categorize Your Current Cash Flow

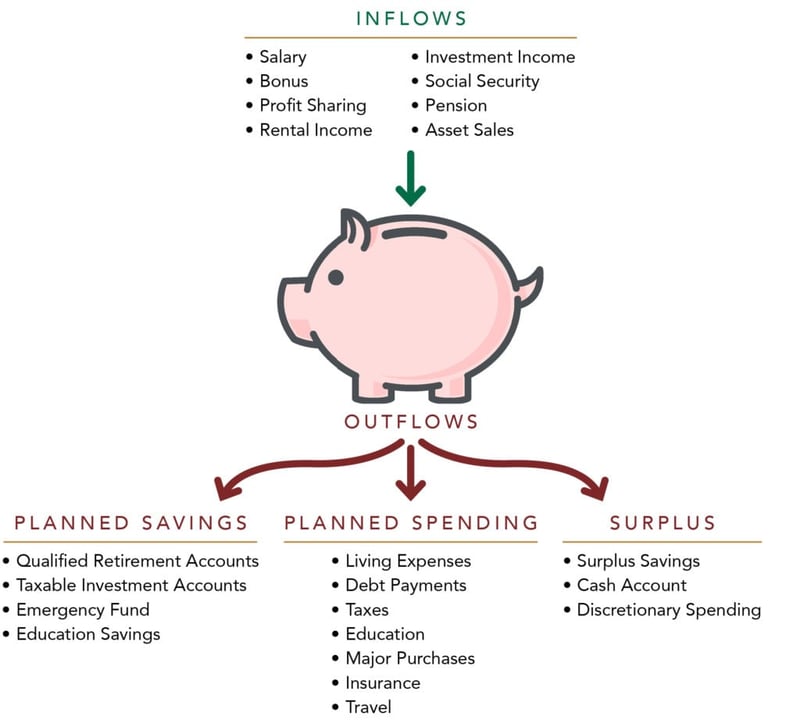

Cash flow refers to the cash inflows (salary, bonus, investment income) coming into your household and the cash outflows (spending or savings) going out of your household. Spending outflows include payments of current living expenses, debt payments (mortgage, credit cards, student debt), and funding the periodic payments you may make quarterly, semi-annually or annually (insurance premiums, property taxes, income taxes, memberships). Savings outflows are your planned savings to retirement accounts, 529 plans, non-qualified (taxable) investment accounts, emergency savings, as well as surplus savings.

Technology has made capturing and categorizing income, spending, and savings a lot easier. Advanced planning software allows you to link financial accounts (bank accounts, debit cards, credit cards, investment accounts, mortgage, insurance premiums) so that daily transactions and balances flow in and are categorized appropriately. This allows you to run monthly expense reports as well as look back over prior months to see what came in and what went out. That makes preparing a realistic estimate of annual income, expenses, and savings more efficient and accurate. Plus, once the accounts are linked in your personal financial portal, tracking your cash flow going forward is automated and continuous.

Step 2: Identify and Quantify Future Cash Flows

After you have a clear view of your current cash flow, the next step is to identify future inflows and outflows. On the income side, you will want to account for future increases in your salary, bonuses, and possibly profit sharing. You may plan to sell assets in the future (real estate, stock options, or the sale of a business) that will generate income. You will receive income in retirement such as social security or possibly pension or deferred compensation income, all of which needs to be accounted for.

Apart from the inflationary growth of living expenses, you may have future planned lump-sum expenses such as private school or college for your children, a house remodel, extraordinary travel, or a second home. With advanced planning software, you only have to identify these future expenses and income streams in today’s dollars and the start and end dates for those flows. The software projects out the inflation-adjusted value of those amounts in the future.

Projecting future cash flows also includes accounting for planned savings and contributions to qualified (tax-deferred) and non-qualified (taxable) investment and savings accounts. Any surplus that is left over after accounting for income, spending and planned savings can also be directed—for planning purposes—to an investment account.

Step 3: Build Your Balance Sheet

Your balance sheet reflects what you own and what you owe. You and your planner will identify and value all your assets (real property, personal property, financial, insurance) as well as liabilities (mortgage, student loans, other debt). In addition to managing expenses, building the financial assets (investment accounts) in your balance sheet during your working years is the key to success in retirement. Once in retirement, you will likely be living off the income generated by, as well as periodic liquidations from, your investment accounts. The greater your investment accounts in retirement, the greater your pay in retirement! Think of it this way: each time you make a contribution to an investment account, you are giving yourself a pay raise in retirement.

Likewise, eliminating the debt on your balance sheet by retirement is also an important objective because zero liabilities will give you greater flexibility in controlling expenses in retirement and will save you interest.

Step 4: Decide on an Investment Plan

You will work with your planning professional to identify savings strategies, time horizon, liquidity needs, and personal risk tolerance. Your planner will then devise and propose an appropriate investment strategy to help you achieve your goals while managing risk. The planner will assign growth rate and volatility assumptions to the proposed portfolios.

Step 5: Tying it All Together: Cash Flow and Asset Accumulation and Depletion Projections

Based on current and estimated future income, spending, and savings, current assets and liabilities, and assumptions on inflation, growth rates, taxes, and personal timelines, your planner can project your annual cash inflows and outflows as well as potential surplus and deficits from the current year through end of life. Your planner also can project how, based on your current balances and future savings and investment strategies, your financial assets will grow year over year and, once in retirement, fund your retirement through income and liquidations (depletions).

The best thing about planning when you are 10, 15, 20, even 30 or 35 years out from retirement is that you have the time and opportunity to modify your spending and savings behaviors to achieve the outcomes you want. High income earners, especially, are often shocked to learn how much it takes in financial assets (income and liquidations) to replace the income they were accustomed to earning in their working years. Through early planning, you can set in place healthy spending, savings, and investment habits so that you will be financially fit today and, over time, grow your financial wellness from good to great.