Category: trust estate

How a Trust Can Protect Your Family from Themselves

You’ve worked hard to build wealth. You have more money than you will need in your lifetime and you want to ensure your assets will benefit your family once you’re no longer at the helm.

Estate Planning For Life!

Estate planning is really “transfer planning.” It is an ongoing exercise of planning how you accumulate, conserve, and distribute your assets during life, at death, and beyond. There are both financial and non-financial reasons to plan. These range from minimizing income and estate taxes,...

The Benefits of Trusts

Trusts can serve many purposes in a family’s financial, retirement, estate, and tax planning. Trusts can ensure that assets are professionally managed across generations and distributed in line with the grantor’s intentions. Trusts can, among other things, remove assets from one’s estate, carry out...

Gift and Estate Planning

Whenever you transfer assets to another person, whether during your lifetime or at death, there are potential federal and state tax consequences. Good financial planning can help minimize taxes and also help you better accomplish your gifting objectives. Although most households will not face Gift...

Legacy Planning

Within the last year, my husband and I revisited our estate plan. In the end, we felt confident that we’d accomplished all the usual objectives—protecting and preserving financial assets for future generations, minimizing taxes, and so forth.

Entrepreneurial Estate Planning

Over the years, a number of clients and friends have approached me to assist them with their estate planning needs. Because my legal license is inactive, I don’t draft estate planning documents. However, with over 30 years of experience in administering estates and trusts, I can often bring an...

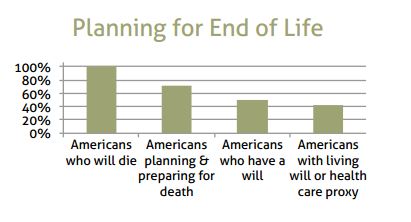

End of Life Planning

Since we are all mortal, we will all personally face end of life issues. It is essential to have appropriate documents in place that will address both financial and healthcare matters that ultimately arise. In a recent survey completed by Boomer Market Advisor, 50% of respondents did not have a...