Category: markets

The Perils of Market Timing

Following a choppy start to 2018, the U.S. stock market climbed 8% in the third quarter. However, most of those gains were given back during the recent sell-off. Even with the pullback, longer term returns have still been impressive: through October 24th, the trailing five-year and ten-year returns...

Notes from the Investment Team

2017 was another banner year for investors. The total return (inclusive of dividends) for the S&P 500 was a gain of 22%. There were not any meaningful hiccups along the way; as shown in the chart below, the index posted positive returns in every single month of 2017. International stocks fared even...

Keeping Our Eyes on Access to Capital

In 2007, you could count the number of companies with a “AAA” credit rating on two hands. General Electric (GE) was among that select group. But decisions made by management over the preceding 10-15 years eventually led GE to lose that top credit rating in 2009 – and seriously tested the company’s...

Notes from the Investment Team

2017 was another banner year for investors. The total return (inclusive of dividends) for the S&P 500 was a gain of 22%. There were not any meaningful hiccups along the way; as shown in the chart below, the index posted positive returns in every single month of 2017. International stocks fared even...

How Investing Transformed Over the Century

I recently read a book on the sinking of the Lusitania in 1915. The author thoroughly details the lives of some of the affluent passengers who were aboard the luxury liner’s final voyage. As I was learning about these “high net worth” people who lived one hundred years ago, I kept wondering about...

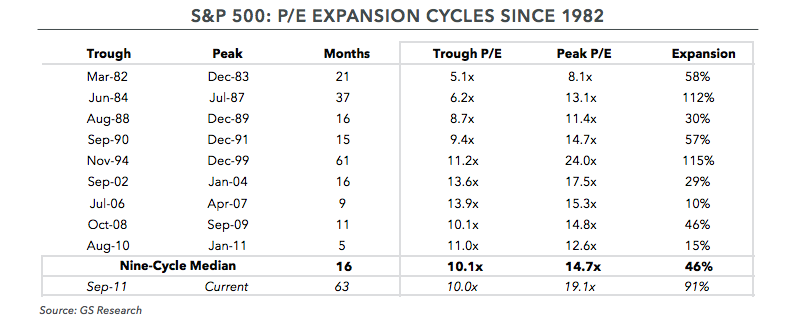

Where We Are in the Cycle

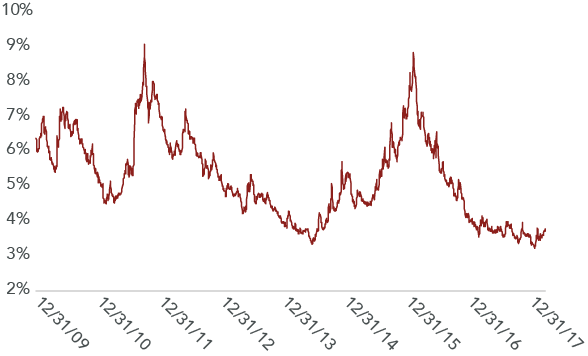

In the fourth-quarter newsletter, we discussed how we think about long-term equity return expectations. The purpose of the article was to explain how fundamental returns (driven by earnings growth) and speculative returns (driven by changes in valuation) collectively impact market prices. While...

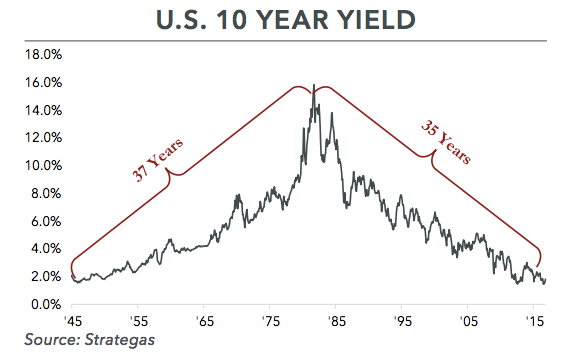

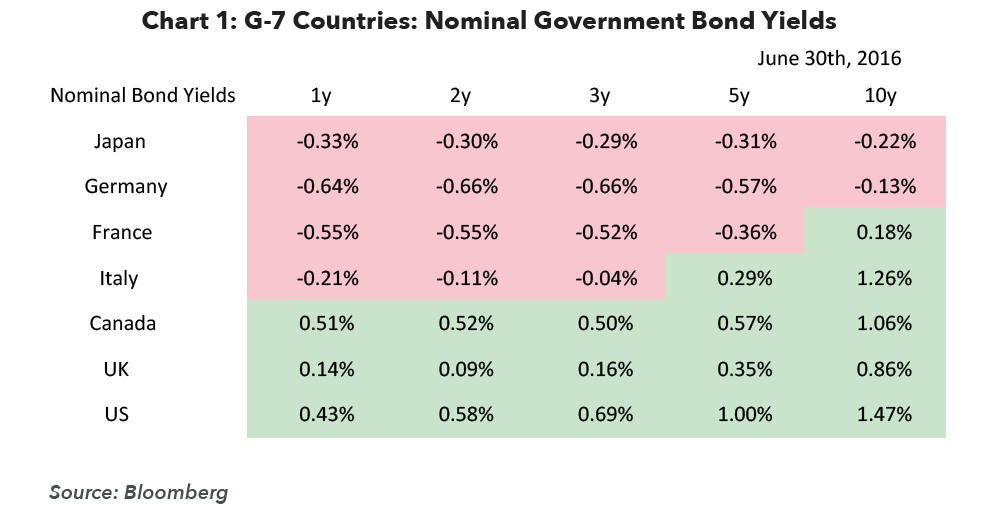

Have we seen the beginning of the Great Rotation?

Over the past 35 years, interest rates on bonds have been in a gradual decline. The decline in interest rates has gone hand-in-hand with rising bond valuations since bond values move inversely to interest rates. Bond investors have thus enjoyed a long period of rising returns due to market...

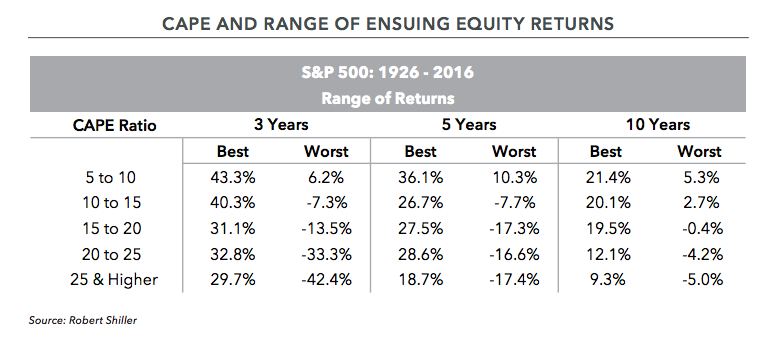

Expectations for Future Equity Returns

The S&P 500 reported its eighth consecutive year of positive returns in 2016, a feat last achieved in the 1990’s. That winning streak appeared in question in early November, with the S&P 500 up roughly 2% for the year. As the U.S. Presidential election approached, the consensus among market...

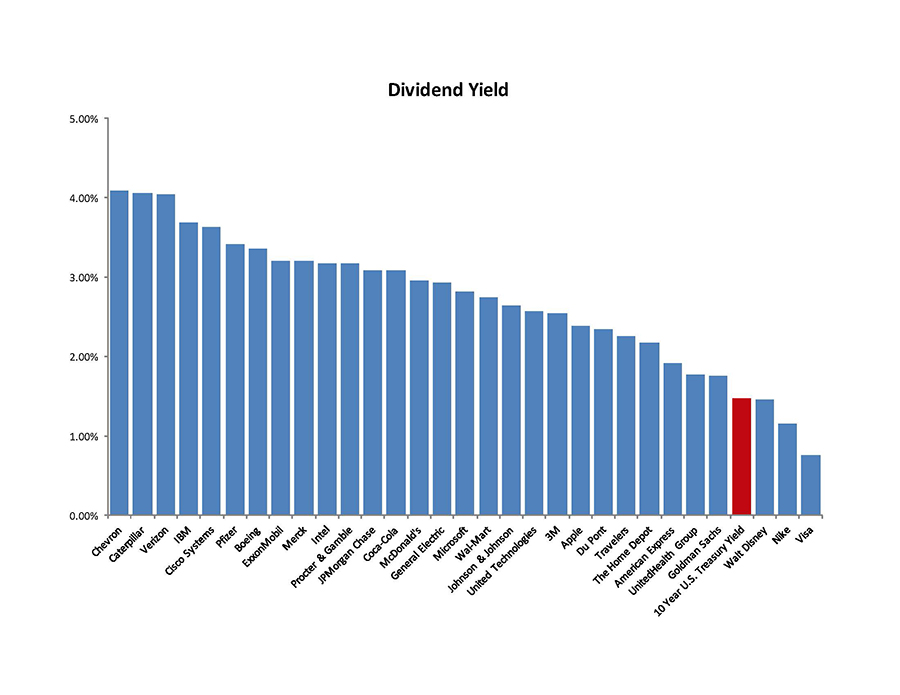

The Reemergence of the Blue Chip Nifty Fifty

“A blue-chip stock is the stock of a large, well-established and financially sound company that has operated for many years. A blue-chip stock typically has a market capitalization in the billions, is generally the market leader or among the top three companies in its sector, and is more often than...

Navigating Macro Choppiness

At the 2016 Berkshire Hathaway shareholder meeting, Warren Buffett and Charlie Munger were asked about the impact of negative interest rates when valuing a business. Warren’s answer touched on the peculiarity of the current environment and how it impacts decision-making at Berkshire Hathaway....