Category: investing

Understanding the Benefits and Risks of Bonds

Especially in times of significant stock market volatility, bonds have an important place in a balanced investment portfolio. The income that bonds generate coupled with their relatively low-price volatility can help mitigate overall portfolio risk. Unlike stocks, which provide equity interest in a...

Navigating Uncertainty and Volatility

We’re currently in the midst of a period of heightened uncertainty, volatility, and panic due to the COVID-19 (coronavirus) pandemic. Clients are justifiably worried.

The Beginnings of The Fiduciary Group: 1970 – 2000

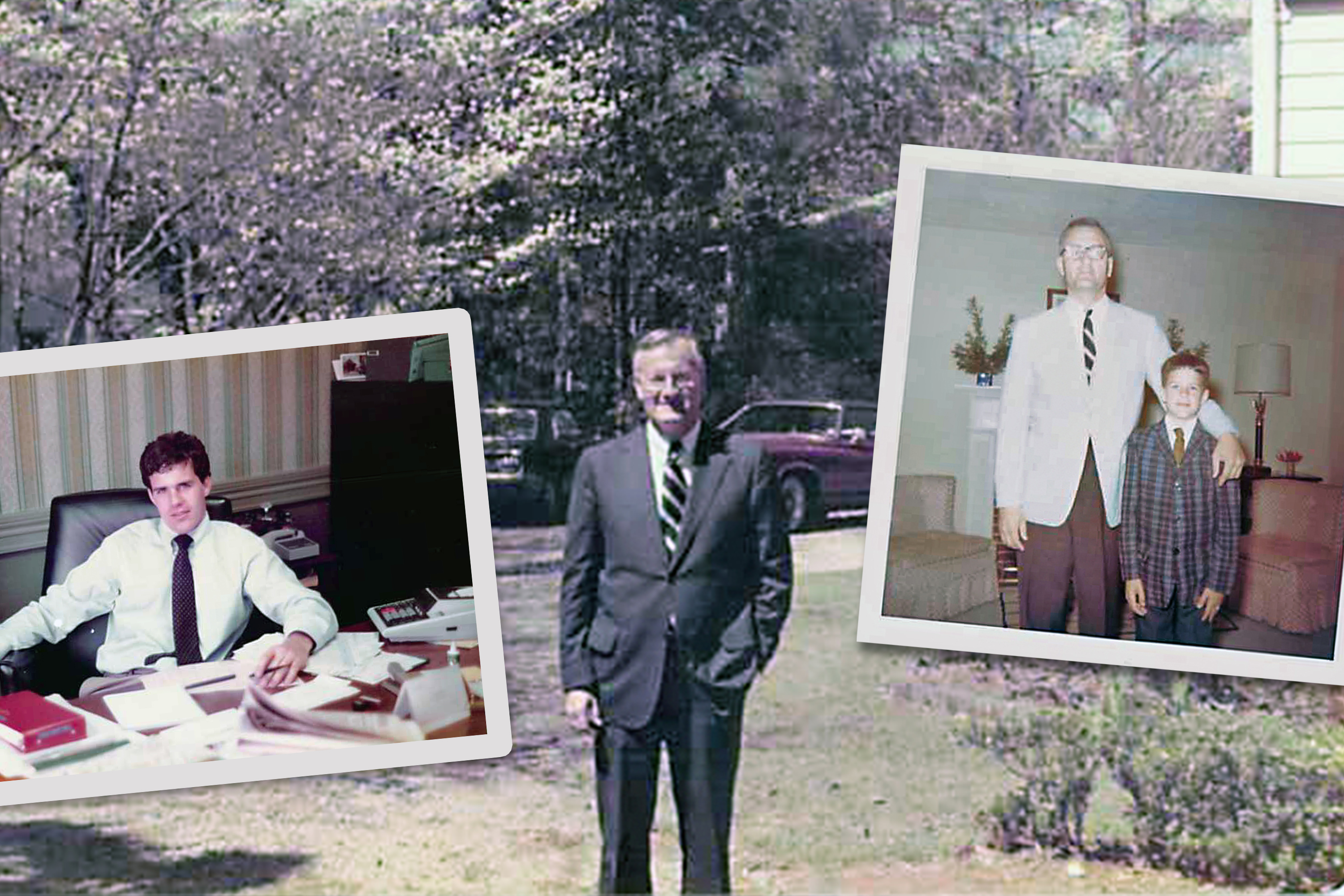

Lee Butler with his son Malcolm in the 1960s. The beginning of The Fiduciary Group dates back to the summer of 1969. I was the Vice President and manager of the trust department of a major Savannah bank. Banking was in turmoil in 1969, including my employer. Under the management at the time, the...

Understanding SECURE Act Changes

Each new calendar year brings about changes in our savings and retirement planning efforts, and 2020 is no exception. With the December 2019 signing of the Setting Every Community Up for Retirement Enhancement (SECURE) Act, Congress set out “to make significant progress in fixing our nation’s...

What to Focus on When Investing for the Future

As we begin a New Year and a new decade, many financial experts are polishing their financial “crystal balls” in an attempt to predict what the market will – or won’t – do in 2020 and beyond. The reality is that no one really knows how the market will perform from day to day, week to week or even...

Public vs. Private Equity

At The Fiduciary Group, our investment universe primarily consists of publicly-traded equities (stocks) and fixed income securities (bonds). From time to time, we receive questions from clients about making investments in non-publicly traded companies. We typically refer to these types of...

Year-End Planning Strategies

It always seems hard to believe, but another year is nearing a close and the holiday season is upon us. Now that we are in the final months of 2019, The Fiduciary Group team is hard at work helping our clients address a variety of year-end planning considerations. The end of the year is a natural...

Is Your Company’s 401(k) Plan Truly Looking Out for Employees?

As a responsible employer, you want the best for your team members and your company. In today’s competitive job market, it’s important to offer your employees an effective 401(k) plan that will help them achieve financial success in retirement as well as improve their overall financial wellness in...

Ignore Elections — Focus on the Long Term

As 2019 draws to a close, we’ve started to field an increasing number of questions about the potential impact of next year’s U.S. Presidential election. Specifically, clients are concerned about the potential impact that specific candidates and the policies they’ve advocated may have on the...

Understanding the Mutual Fund Selection Process

For many of our wealth management clients, we gain exposure to certain asset classes through hiring mutual fund managers. With thousands of available options, selecting a mutual fund is a daunting task for many investors.