CONSERVE. PLAN. GROW.®

Staying Long-Term Focused During Volatile Times

October 30, 2020

Between the pandemic, political uncertainty, and civil unrest, investors have had no shortage of events to contend with during 2020. Combined with outsized stock market volatility, this year has shown no mercy in its contempt for a healthy investor psyche. Being invested in equities during these volatile times can prove difficult, but it continues to be necessary not to get emotionally trapped into short-term thinking. It’s as important as ever to apply a long-term strategy and perspective to your investment portfolio.

As we move further from the peak of pandemic related fears, there is a natural tension between improving fundamentals (both company specific and macroeconomic data) with fears of a second COVID wave. Entwined in all of this is uncertainty around the U.S. election results. One thing that seems clear is that both sides of the political aisle and the Federal Reserve seemed poised to provide ample fiscal and monetary stimulus as they did in March.

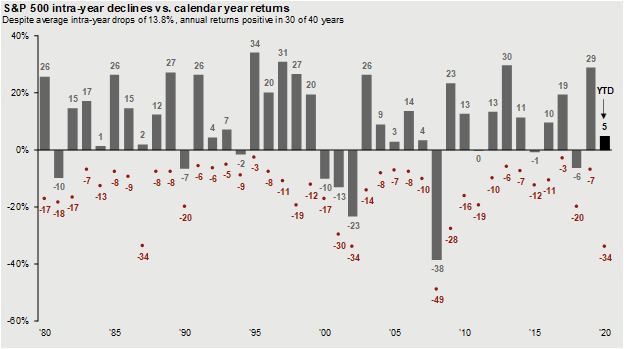

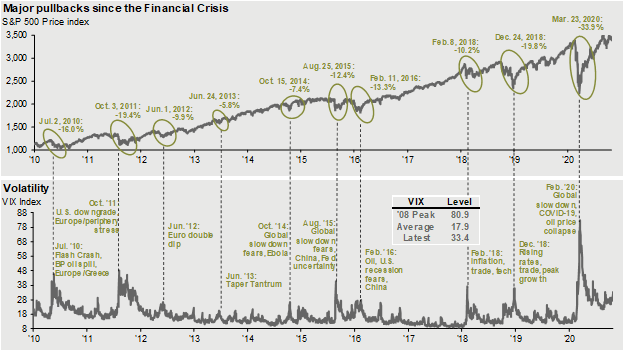

It’s important to understand that markets are inherently volatile, even without the impact of extreme events like a pandemic. The above chart shows calendar year returns for the S&P 500 over the past 30 years versus the largest drawdown sustained by the index during each calendar year. Most years see a double-digit intra-year decline, averaging about 14%. The following chart shows what investors have contended with since the global financial crisis, with eight declines of 10% or more over the past 12 years.

Investor time horizons and the ability to make rational investment decisions are often casualties of market volatility. There is a natural proclivity for short-termism to take hold when bad news and portfolio losses appear unending. One of the primary requirements for long-term investment success is the ability to fend off emotion driven decision making. This is tested at troughs and peaks when time horizons shrink. Irrationality takes hold, which often leads to capitulation (fear at the bottom and greed at the top).

While it might feel good to remove the burden of market volatility from your portfolio, the penalties for doing can be pronounced. The low point for the S&P 500 Index to date in 2020 was March 23rd. Had you reacted to the precipitous decline by selling out of the market, you would have missed a 17% recovery during the following five trading days, which accounts for roughly one-third of the total recovery the market has experienced since that time (through the end of October). That is to say, the most emotionally challenging moments as an investor are often immediately followed by substantial recoveries. If you are on the sidelines for these upturns, your portfolio’s road to recovery becomes considerably longer.

Every client’s emotional quotient is different. The assessment of that quotient is something we, as advisors, are tasked with understanding. Analyzing a client’s financial history, their unique circumstances, and their own assessment of their risk tolerance is critical to understanding a client’s willingness to accept risk. This is so important because it allows us to customize a client’s long-term asset allocation target. A personalized balance of risk and return should help to mitigate irrational investment decision making in the future.

The output from this exercise is a long-term asset allocation, which serves as our guidepost for rational portfolio decision-making. Asset allocation optimizes one’s return and risk objectives and directly embeds a client’s risk tolerance into their portfolio construction. By combining a portfolio of risky assets, like stocks, with less risky and low correlated assets, like high-quality bonds, volatility can be dampened to meet a client’s risk goals while also allowing them to meet their long-term financial goals.

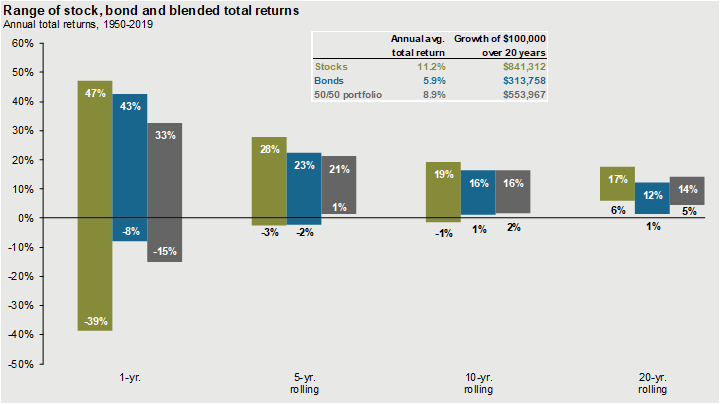

Life would be much easier if we were able to predict the future, but sadly we do not have perfect foresight. We must base our portfolio decisions on information readily available at the time and be thoughtful and forward-thinking when performing fundamental research and due diligence. How we get grounded, and how you should too, is through understanding that the odds of success in equity markets improve drastically as you expand your time horizon. From day-to-day, your odds of making money are not much better than a coin flip; but as you extend your perspective, the probabilities stack heavily in your favor. The below chart shows the historical range of outcomes on one, five, 10, and 20-year timeframes. As you extend your time horizon, the range of expected outcomes narrows and is notably positive.

If you think back to significant market declines, including the one we experienced in February and March of this year, they tend to be caused by external, unusual risks. These risks, combined with a loss of confidence among market participants in the face of uncertainty, can send equity prices into a tailspin. The ways we ensure portfolios weather these storms is through:

- Thoughtful risk tolerance setting with clients.

- Establishing long-term strategic asset allocation targets based on that risk tolerance and overall financial goals.

- Constructing globally diversified portfolios of high-quality investments.

- Continuously monitoring and revisiting as circumstances change.

This year has been the most challenging for investors since the global financial crisis of 2008, and we still have two months ahead of us. Whatever unexpectedly arrives next, we will apply our disciplined process with a long-term perspective to the best of our abilities to continue serving the needs of our clients.

As always, please contact us if you have any questions or concerns.