READ OUR PUBLICATIONS

We send monthly newsletters to our clients, colleagues, and interested parties.

Have we seen the beginning of the Great Rotation?

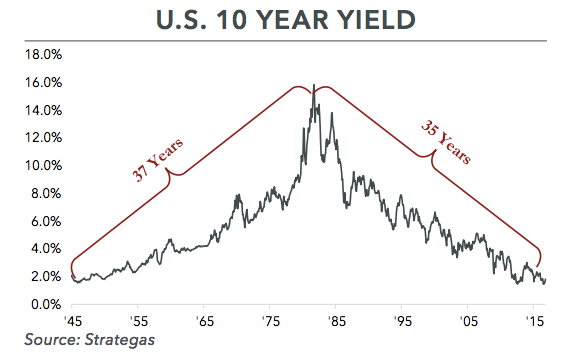

Over the past 35 years, interest rates on bonds have been in a gradual decline. The decline in interest rates has gone hand-in-hand with rising bond valuations since bond values move inversely to interest rates. Bond investors have thus enjoyed a long period of rising returns due to market...

Expectations for Future Equity Returns

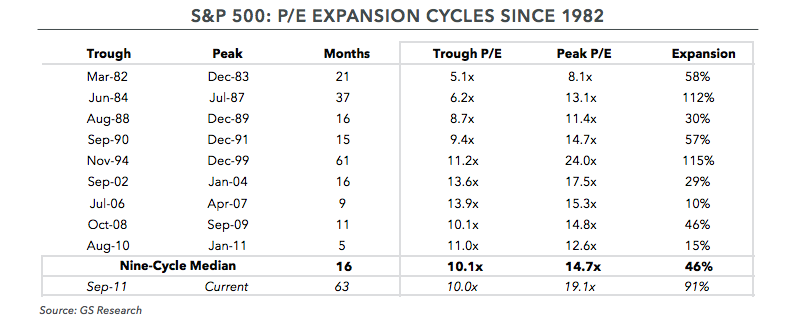

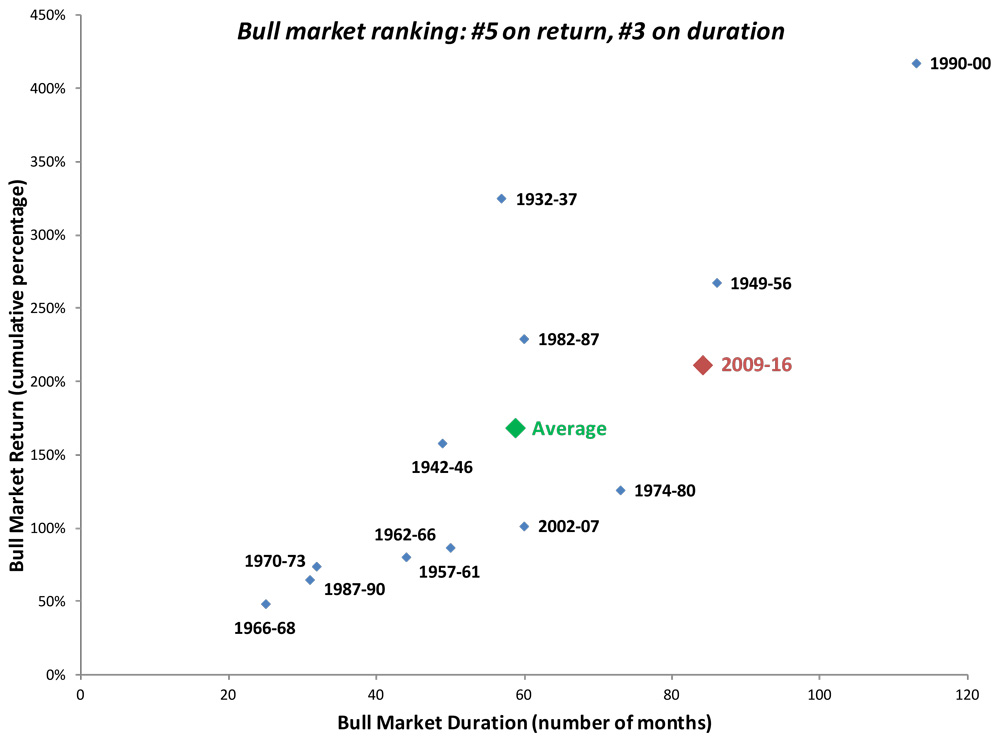

The S&P 500 reported its eighth consecutive year of positive returns in 2016, a feat last achieved in the 1990’s. That winning streak appeared in question in early November, with the S&P 500 up roughly 2% for the year. As the U.S. Presidential election approached, the consensus among market...

The Benefits of Trusts

Trusts can serve many purposes in a family’s financial, retirement, estate, and tax planning. Trusts can ensure that assets are professionally managed across generations and distributed in line with the grantor’s intentions. Trusts can, among other things, remove assets from one’s estate, carry out...

An Asset Manager Embraces Financial Planning

I have been investing other people’s money for over 36 years. As most of my clients are either saving for retirement or living off of their retirement savings and/or trust accounts, my overriding goal has been to build durable, income-producing portfolios that will enable my clients to live off of...

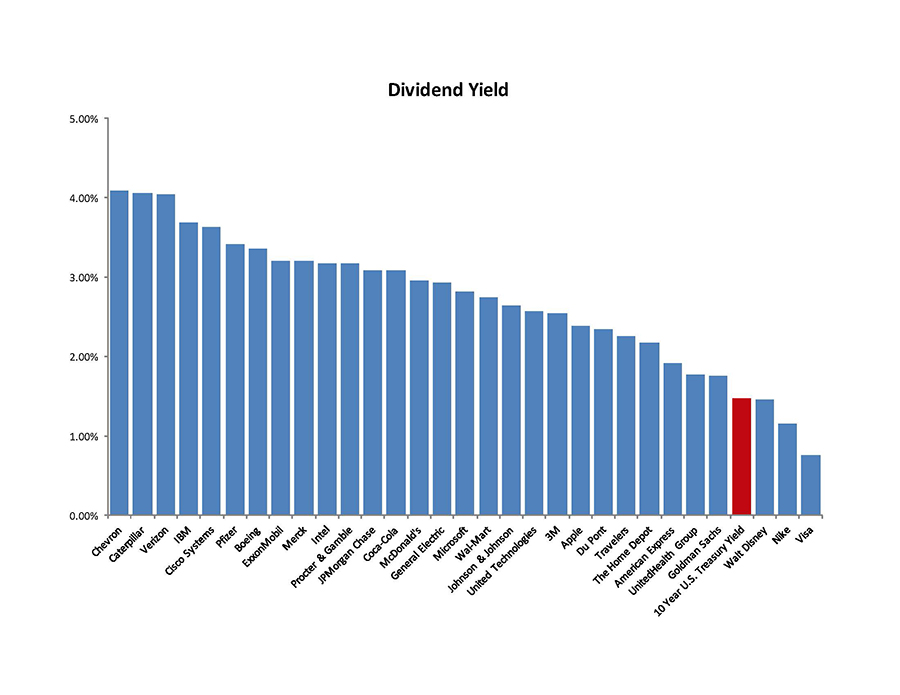

Chasing Good Companies, Not Yield

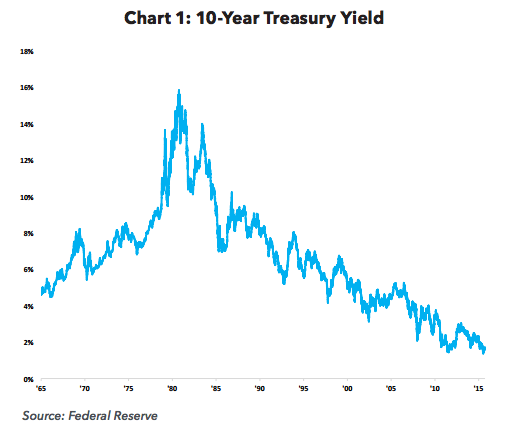

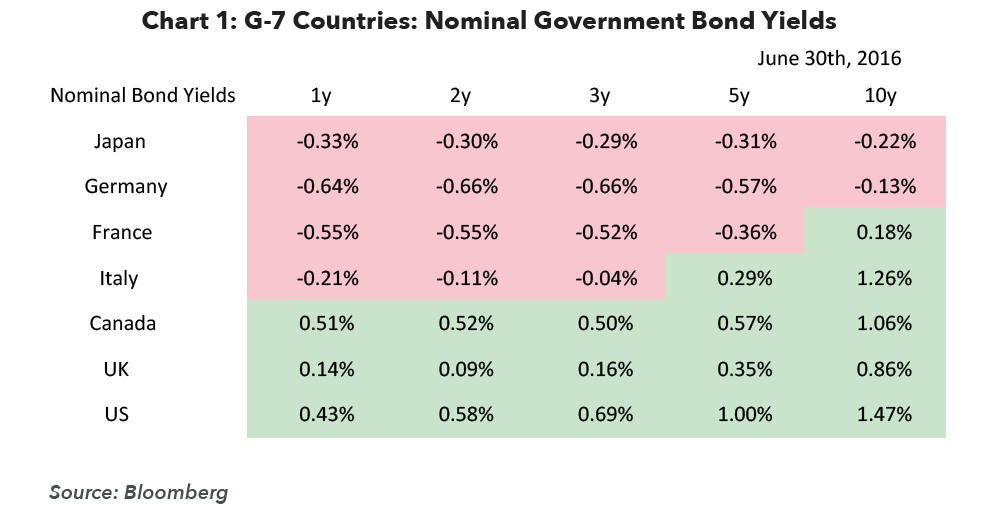

In the second quarter newsletter, we noted there were more than $10 trillion of negative-yielding bonds around the world. While U.S. Treasury bonds are not in that group, they are pretty close: the 10-year Treasury currently yields 1.6%, compared to an average of 6.5% over the past 50 years.

Primer on Individual Taxes

Tax planning to minimize tax liability and maximize after-tax returns starts with an understanding of Form 1040, the tax return filed annually by individual taxpayers. My goal in this article is to give the reader a “primer” on Form 1040 and the key considerations that will impact your tax...

The Reemergence of the Blue Chip Nifty Fifty

“A blue-chip stock is the stock of a large, well-established and financially sound company that has operated for many years. A blue-chip stock typically has a market capitalization in the billions, is generally the market leader or among the top three companies in its sector, and is more often than...

Navigating Macro Choppiness

At the 2016 Berkshire Hathaway shareholder meeting, Warren Buffett and Charlie Munger were asked about the impact of negative interest rates when valuing a business. Warren’s answer touched on the peculiarity of the current environment and how it impacts decision-making at Berkshire Hathaway....

Gift and Estate Planning

Whenever you transfer assets to another person, whether during your lifetime or at death, there are potential federal and state tax consequences. Good financial planning can help minimize taxes and also help you better accomplish your gifting objectives. Although most households will not face Gift...

Long-Term Thinking

The sideways market of 2015 became even more indecisive in the first quarter of 2016. The S&P 500 Index stumbled out of the gates, and was down more than 10% by early February. In the ensuing weeks, the Index made a strong turn higher, ending the first quarter up marginally. At quarter end, the...