READ OUR PUBLICATIONS

We send monthly newsletters to our clients, colleagues, and interested parties.

The Path to Value Realization

For many years, we’ve heard market prognosticators proclaim that the current bull market is nearing its fateful end. Between the Euro crisis, the U.S. debt downgrade, concerns about China, Brexit, the “taper tantrum,” and now the threat of an expanding trade war, they have offered plenty of reasons...

The Team Continues to Grow!

The Fiduciary Group is excited to announce two additions to the TFG team: Brendan Flaherty and Bess Butler.

When I’m Not Working…

It all started with a small plot in a community garden. When I harvested my first bell pepper, I was hooked. After a few years bending over two planter boxes at ground level, I decided to “straighten up.” Literally, I wanted to stand up while I worked in my vegetable garden. With the help of Farmer...

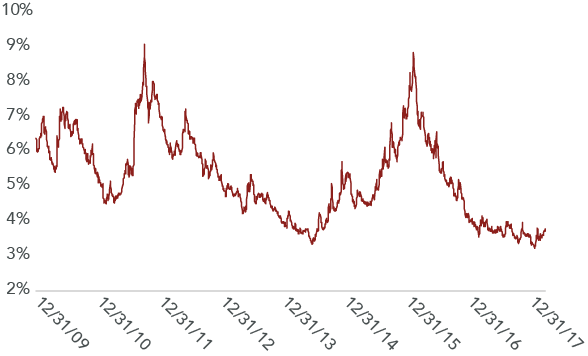

The Impact of Inflation

From the end of 2017 through April, inflation has increased from +2.1% to +2.5% (using CPI as a proxy). Over the same period, the yield on ten-year Treasury bonds has risen from 2.4% to 3.0%. These moves have led market participants to question if a change in the status quo is underway. Let’s...

From Our Family to Yours: 4 Ways to Teach Kids About Money

Teaching kids about money in the Digital Age isn’t always easy. Between online shopping, direct-deposit paychecks and banking by app, today’s children are growing up in a world where they may rarely experience a cash purchase or even a monetary transaction. To kids, it can look like the next item...

Berkshire Trip 2018

In early May, I attended the Berkshire Hathaway shareholder meeting in Omaha, Nebraska. The event, dubbed “Woodstock for Capitalists,” attracted more than 40,000 attendees from around the world.

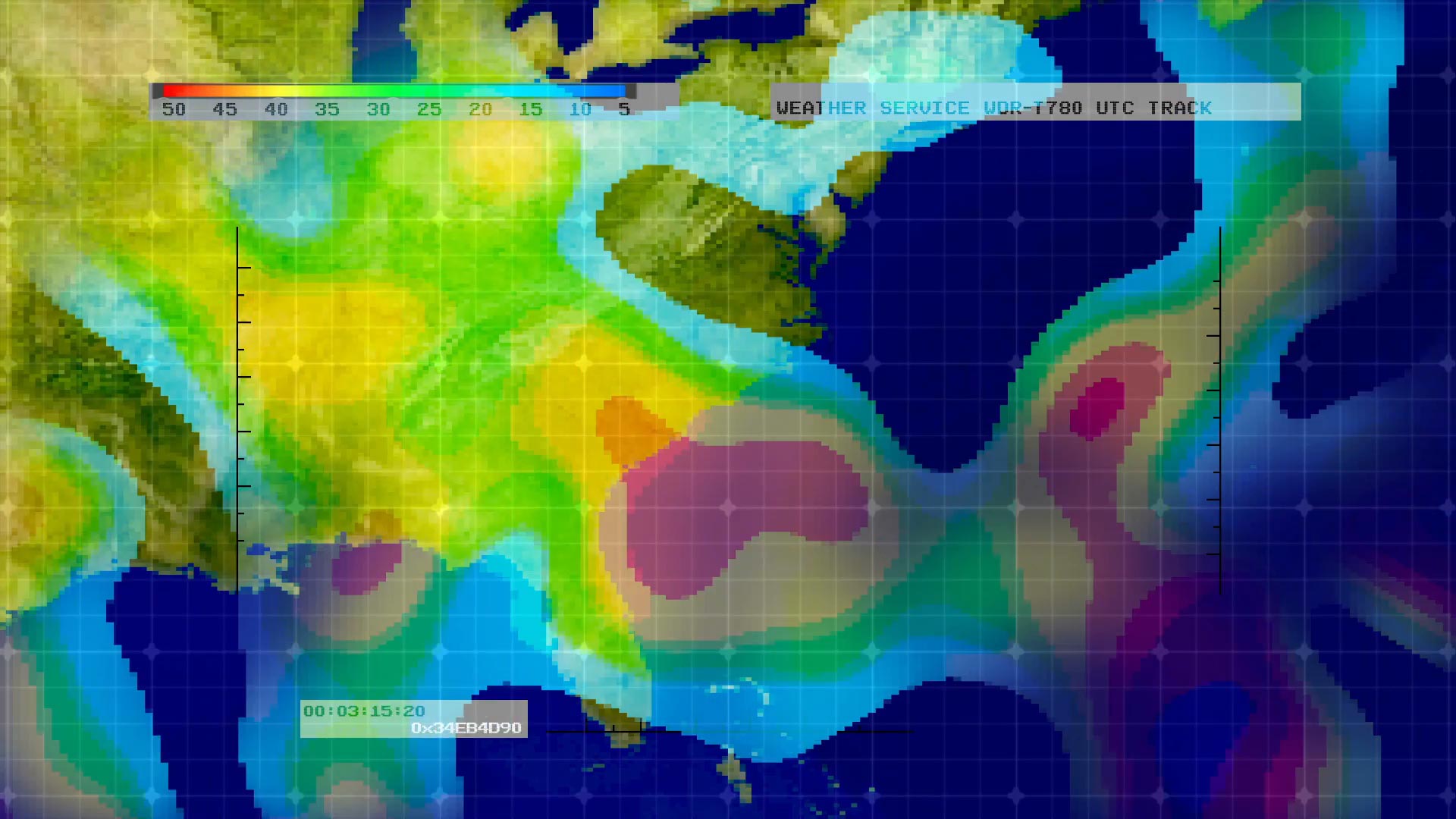

All-Weather Portfolio Construction

It seems that there has been an increase in severe weather these days including floods, fire, and wind. In Savannah, we suffered a direct hit from Hurricane Matthew last year and endured a mandatory evacuation this year due to Hurricane Irma. Hurricanes are a constant threat during the summer and...

Notes from the Investment Team

2017 was another banner year for investors. The total return (inclusive of dividends) for the S&P 500 was a gain of 22%. There were not any meaningful hiccups along the way; as shown in the chart below, the index posted positive returns in every single month of 2017. International stocks fared even...

An Antidote to Volatility

“Antidote”: Something that works against an unwanted condition to make it better.

Keeping Our Eyes on Access to Capital

In 2007, you could count the number of companies with a “AAA” credit rating on two hands. General Electric (GE) was among that select group. But decisions made by management over the preceding 10-15 years eventually led GE to lose that top credit rating in 2009 – and seriously tested the company’s...