CONSERVE. PLAN. GROW.®

This is the fourth installment in a series on the Investment Process of The Fiduciary Group. Before jumping into the subject of selecting investments, let’s recap the key takeaways from the first three steps in our investment process.

Execution of any important undertaking is more effective when planning precedes action. Effective planning helps us identify where we are, what we want to accomplish, and how we’re going to get there. It also lets us measure our success along the way. When it comes to investing, a good plan includes both a cash flow plan (what you envision earning, saving, and spending in the coming period) as well as a balance sheet analysis (what you own, what your assets are worth, what income your assets generate, how much you plan to add to or withdraw from your investment account, and how much you owe). With proper planning, you can more effectively keep spending in line with your investment income, anticipate the amount of assets you will need to meet future liabilities, and know how much you need to save to meet your goals. By planning when and how you will use your investment account and what you will likely be contributing or withdrawing, you also are better able to select an investment strategy in line with your needs, objectives, and timing.

An investment strategy should be driven by the clearly defined objectives which you seek to accomplish (e.g., preservation of capital, generation of income, growth of capital), the nature and timing of planned withdrawals, and the risks (e.g., volatility, liquidity) which you seek to manage. An effective investment strategy should deliver well-defined risk/ return objectives. Each strategy carries with it a range of expected returns as well as a range of expected volatility (usually measured by standard deviation). Usually the higher the expected annualized return, the higher the volatility risk (bigger swings in valuation from period to period). You need to make sure you have good alignment between your overall objectives for your investment assets, your time horizon for planned withdrawals, your investment strategy, and your expectations of the risk/ return characteristics associated with that strategy.

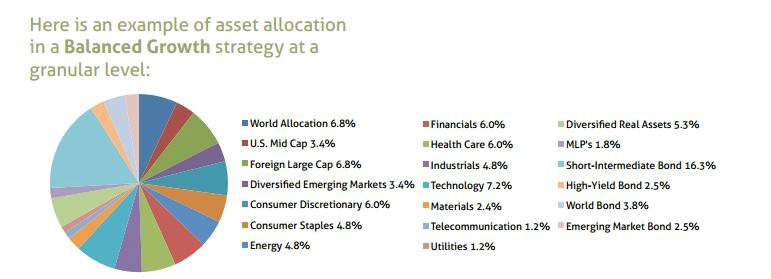

Once you’ve chosen a strategy—such as Capital Preservation, Balanced Income, Balanced Growth, or Growth—asset allocation is the key to implementing the strategy. In its biggest sense, asset allocation refers to how much of the portfolio is allocated to each of the 3 major asset classes—stocks, bonds, and cash. Stocks are principally the growth engine of a portfolio, and to the extent the strategy prioritizes growth of capital, assets will likely be weighted more heavily to stocks. Bonds provide income and some cushion from volatility; thus to the extent that capital preservation and income generation are prioritized, asset weighting may favor bonds.

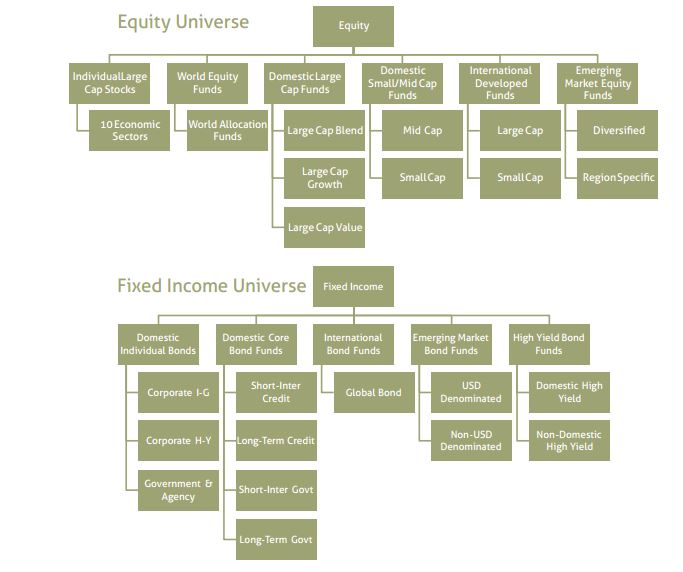

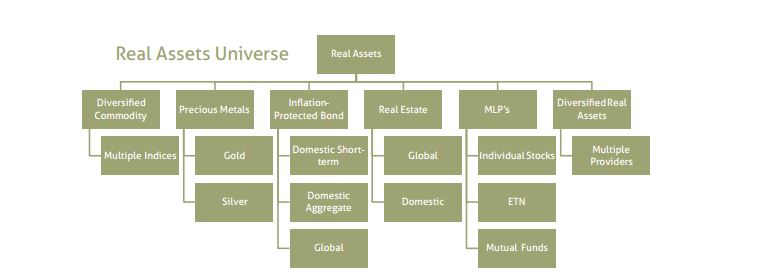

At a more granular level, asset allocation involves deciding how much—within each of the 3 major asset classes—to allocate to the various sub-categories in order to diversify across economic sectors, geographies, and market capitalization. For example, within the universe of stocks, we decide—among other things—how much to weight domestic large, mid, and small-cap stocks, and international and/or emerging stocks, and within the universe of bonds, we decide how much to weight to corporate, government, agency, and/or high yield securities.

We establish a strategic asset allocation that seeks to balance expected risk and return over a long-term investment horizon. We analyze historical data (performance, volatility, and correlations between and among asset classes over different time periods and economic environments) as well as the current market environment and relative valuation of assets to determine our strategic asset allocation for each investment strategy.

Once the asset allocations for a given strategy have been established, the next step in the investment process is to decide what specific holdings will fill each of those categories. This is the process of investment selection, and the focus of this article.

Implementation of asset allocation targets is achieved through the selection of individual securities, mutual funds, and/or exchange traded funds (ETFs). Because we trade on an open-architecture platform, our universe of publically-traded, daily valued investments is quite broad. They can be best understood by grouping them into 3 categories—Equity, Fixed Income, and Real Assets. Our job is to select the best investments within each of those subcategories so that we have an appropriate “menu board” from which we can construct individual portfolios and model portfolios.

We subscribe to and obtain global data and analysis from a number of sources to inform our decision making process. Our investment team conducts independent due diligence, analysis, and ongoing monitoring of investments (individual securities and managers).

When purchasing equity securities, we target high quality companies that have a compelling business and a talented management team with a track record of thoughtful capital allocation decisions, and which are trading at reasonable valuations.

We perform fundamental analysis of securities based on both historical and prospective data. Quantitative screening includes price to earnings (P/E) ratio, price to book value, price to sales, free cash flow yield, dividend yield, dividend growth, debt to capital ratio, and return on equity. Qualitative screening includes competitive market position, management skill, and macroeconomic factors.

When purchasing fixed income securities, we place top priority on the return of capital. We evaluate interest rate and credit risks relative to the anticipated return to ensure we are being reasonably compensated for the risk we assume. In analyzing a bond instrument, we review its yield versus its rating-category peers, its yield versus other forms of debt such as treasuries, the future prospects of the issuer’s business, and the current debt level of the issuer. We then perform a cash-flow based analysis of the issuer’s likelihood of repaying the bond. The overriding goal is to identify bonds at attractive yields that are expected to be repaid at maturity

In selecting mutual fund managers, we use a thoughtful quantitative and qualitative due diligence process in which we seek to identify top managers in each respective asset class. Our quantitative analysis starts with fundamental research of multiple data bases and a comparative analysis of extensive information about the managers, portfolio composition and structure, fund expenses, performance attribution, and risk statistics.

Qualitative analysis includes phone calls, in-office meetings, conferences, and on-site visits to understand the fund’s management, culture, and processes which contributed to the quantitative results in order to inform our expectations about future performance. We seek to understand how the manager selects investments, what information is used, how that information is analyzed, and the processes and controls that define how conclusions are executed and reviewed.

Whether selecting individual securities or fund managers, we seek to exercise our best judgment based on a disciplined process, independent research, and thoughtful analysis, and always with the best interests of our clients at heart. Investment selection is not a one-time activity but rather the start of a continuous cycle of ongoing monitoring, review, and replacement of investment options where appropriate. Once the investments for the various asset categories are chosen, the next step is constructing, revising, and re-balancing portfolios to implement the selected investment strategy based on a particular client’s needs