JULIA BUTLER, CFP®, JD, MBA, CFEI

READ OUR PUBLICATIONS

We send monthly newsletters to our clients, colleagues, and interested parties.

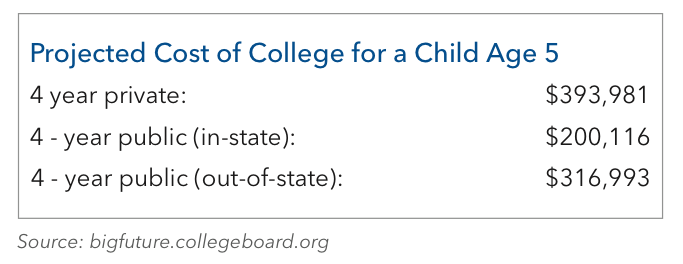

Self-Funding A College Education

Funding a child’s or grandchild’s education is a high-priority savings goal for many families. This article will answer a few important questions:

Active vs. Passive Mutual Funds

Are mutual fund investors better served by investing in actively or passively managed mutual funds and ETFs? Short answer: depending on one’s individual circumstances, both types of funds can play a positive role in a well-diversified investment portfolio. Diversification among active and passive...

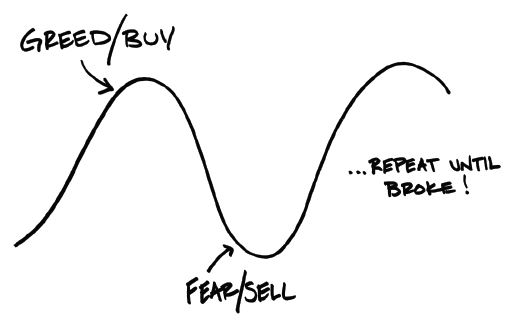

Putting the Brakes on the Emotional Rollercoaster

Emotions can cause investors to do the wrong thing at the wrong time. We all know, rationally, we should buy low and sell high. Yet emotions can cause investors to do just the opposite.

The Gen-X 401(k) Millionaire

Generation X—those born between 1965 and 1978—is known as the “401(k) generation.” They entered the workforce about the time that 401(k) plans were being introduced, and started their own retirement savings earlier than prior generations (the average age to start saving for retirement was 27). They...

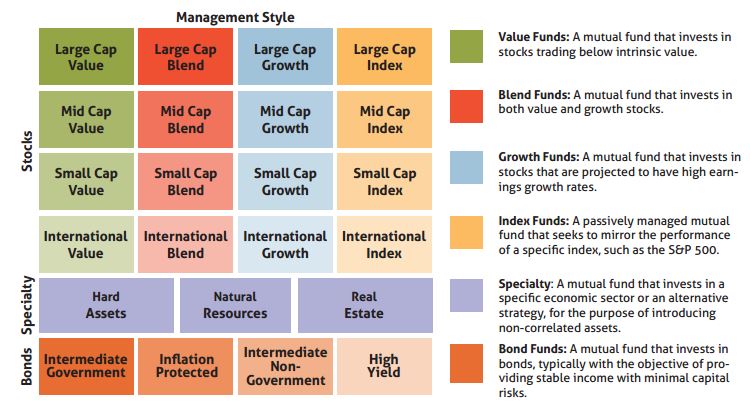

Understanding Mutual Funds

When I meet with 401(k) participants to educate them about saving and investing, I always start with the basics—explaining, among other things, what stocks, bonds, and mutual funds are, and how and when they might be utilized in an investment portfolio. Because participants seem to find this...

Coming Of Age During The Great Recession

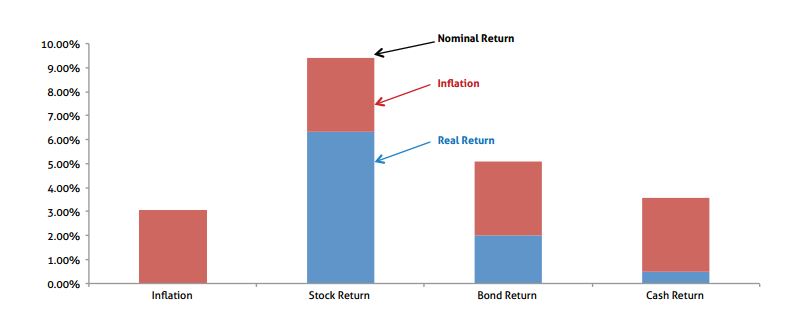

The financial crisis and associated market volatility has caused a lot of people to lose confidence in the stock market. No group appears to have been more scarred by 2008, however, than the Millennials—the 21-36 year olds who “came of age” as investors over the last 10+ years. This chart tracks...

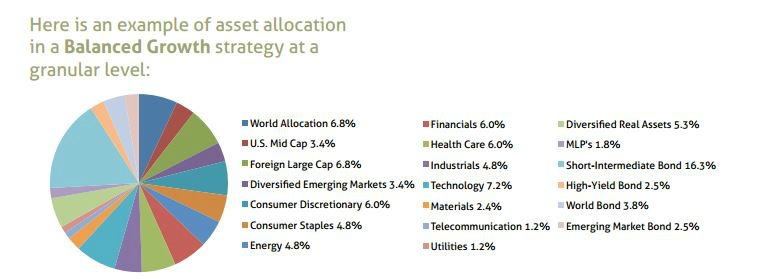

Investment Selection

This is the fourth installment in a series on the Investment Process of The Fiduciary Group. Before jumping into the subject of selecting investments, let’s recap the key takeaways from the first three steps in our investment process.