CONSERVE. PLAN. GROW.®

All-Weather Portfolio Construction

May 30, 2018

It seems that there has been an increase in severe weather these days including floods, fire, and wind. In Savannah, we suffered a direct hit from Hurricane Matthew last year and endured a mandatory evacuation this year due to Hurricane Irma. Hurricanes are a constant threat during the summer and fall, and we have learned to prepare appropriately so that we limit any damage or inconvenience caused by the high winds, heavy rain, and storm surge that accompany these major storms.

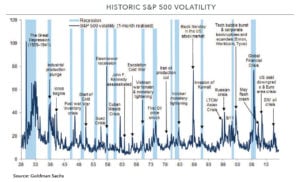

Our investment portfolios likewise will encounter stormy conditions from time to time. Economic recessions can negatively impact businesses and the value of our equity holdings. Rising inflation can undermine the value of our fixed income investments. Steep market declines occur from time to time and can rattle investor nerves and undermine our outlook for future market performance. For the first three quarters of this year, the average daily change of the S&P 500 index was a mere 0.3%, the lowest in nearly 50 years. While market conditions have been quite benign this year, we should always expect market volatility and reversals to occur at any time.

As we have learned how to properly prepare in advance for hurricanes, we have likewise learned how to construct all-weather portfolios built to withstand market volatility. Prudent portfolio construction starts with asset allocation. Based on factors including client investment goals and objectives, investment time horizon, investor risk tolerance, and investor cash flow needs, we can prepare an asset allocation plan that serves as the map that will help the investor achieve his financial goals. We commonly refer to this plan as our Investment Policy Statement (IPS).

The three principal assets available to investors are equities (also referred to as stocks), fixed income (bonds), and cash. Equities represent ownership in a business. Fixed income assets are the debt of the business. In the corporate capital structure, owners of the debt have a preferred return over owners of the equity. Thus, fixed income investments typically carry less risk of loss and therefore lower expected investment returns. Equity asset valuations are more volatile than fixed income asset valuations and historically have provided higher returns than fixed income investments over extended periods of time. Cash has virtually no risk of loss and as a result earns much lower returns than either equities or fixed income. Teaming these three assets together pursuant to the IPS is at the core of professional wealth management.

In crafting a portfolio, we need to balance the investor’s desire for strong investment performance with the investor’s intolerance of market turbulence. The essential distinction between equities and fixed income assets is that they are non-correlating assets. Typically, when equities rise in value, the fixed income investments will decline in value. And when equities are falling in value, fixed income values will rise. The appropriate combination of these non-correlating investments will yield investment returns that are consistent with our IPS. In our role as risk managers, we seek to appropriately allocate these investment assets to help the portfolio successfully endure inclement market weather.

Within the equity and fixed income asset classes, we want to achieve appropriate diversification to reduce the risk of any one asset undermining portfolio returns. For the equity portion of the portfolio, we want to primarily invest in domestic securities, but we also want representation in international and emerging markets. Among domestic securities, we will primarily invest in larger companies, but we also want to have a portion invested in smaller companies. Typically, smaller companies have generated higher returns over long periods, but there is also a higher risk of loss or volatility not normally experienced by larger, more seasoned businesses. Among our domestic equity investments, we also want to be diversified across economic sectors so that the portfolio has representative investments in all areas of the economy. Multiple levels of diversification serve to limit volatility within the equity portion of the portfolio.

In the fixed income asset class, there are two essential elements that need to be balanced. The first, credit quality, is a function of the probability of the issuer making timely payments on the bond and repaying the principal balance of the bond at date of maturity. The second, interest rate risk, is the risk of fluctuating interest rates. The longer until the bond matures, the greater the interest rate risk. Duration is the measurement of this interest rate risk. Since we rely on the fixed income portion of the portfolio to be the less volatile portion, we focus on holding fixed income assets with high credit quality and lower duration.

In addition to properly building the portfolio, we also need to employ a strategy of minimizing the erosion of portfolio values when a portfolio is subject to investor withdrawals. By holding an adequate allocation to cash and fixed income assets, we can take comfort in knowing that we can let our equity investments ride out any storms, no matter how long the storm may last. A typical asset allocation might be 70% stocks and 30% fixed income and cash. If the annual withdrawal rate from the portfolio is 4-5%, then there is easily 7 or more years of fixed income and cash assets available to cover withdrawals, assuming a 2-3% annual cash return from the dividends and interest earned on the portfolio assets. Given this sufficient withdrawal coverage, there is more than enough time to let equity values overcome a market downturn.

We encounter severe weather throughout the year. Where we live, we must be prepared for extremely severe weather for a third of the year. We take advance precautions like stockpiling water and other provisions, securing outdoor furniture and pre-planning evacuation routes. Our portfolios will also encounter periods of extreme volatility during the year. We design portfolios to minimize the emotional pain of volatility and the deleterious effects of valuation declines. This is particularly important if the investor is making regular withdrawals from the portfolio. By practicing good techniques of prudent portfolio construction and sound withdrawal strategies, portfolios can be built and maintained to overcome even the worst events affecting our investments.