WEALTH MANAGEMENT FOR INDIVIDUALS AND FAMILIES

FINANCIAL PLANNING FOR INDIVIDUAL AND FAMILIES

Do you and your family have a sound game plan for managing your financial lives? Are you and your spouse on the same page financially? Are you on track saving for your children's and/or grandchildren's educations? Do you have a clear view of your projected investment assets, sources of income, and cash flow in retirement? Are you sufficiently managing risks of prema-ture death or disability? Are your assets sufficiently protected from creditors and properly structured to accomplish your es-tate and legacy goals? Are you confident that your current in-vestment strategy is in line with your goals and risk tolerance?

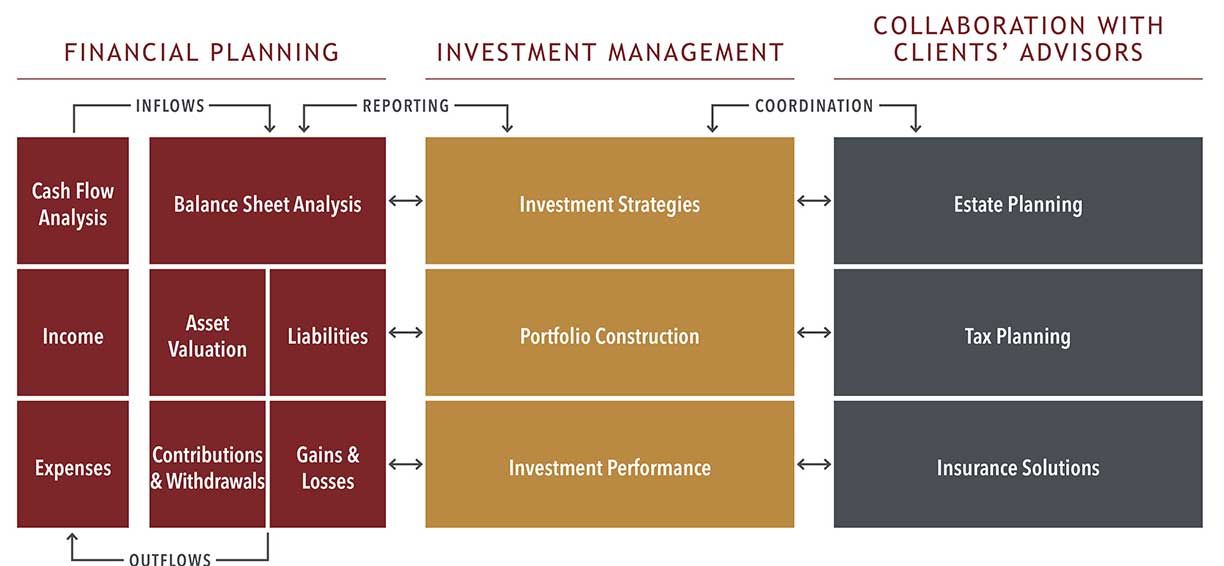

These are just a few of the questions which The Fiduciary Group advisors can help you answer. We offer comprehen-sive fee-only financial planning for individuals and families, with two main objectives: 1) provide a clear, objective view of your current financial situation as it relates to your goals, needs, and family dynamics; and 2) help you understand, monitor, and manage the variables that will help you achieve your goals and manage your risks.

INDEPENDENT AND OBJECTIVE

We are fee-only financial planners, which means we work only for you. We are your advocate and trusted advisory. Our only compensation is paid by you, not a third party. We do not sell products or accept commission income. As fiduciary planners, our advice is objective and based on your best interests.

FOCUSED ON WHAT'S IMPORTANT TO YOU

Depending on your financial life-stage and specific circum-stances, you may have different financial priorities and con-cerns. We focus on the particular needs you would like to address, which may include:

- Cash Flow Management

- Savings Strategies Str Investment Strategies and Implementation Education Planning

- Pre- and Post-Retirement Planning

- Survivorship and Disability Planning

- Multi-Generational Legacy and Estate Planning

COLLABORATIVE TEAM LEADERSHIP

We seek to understand both your financial and non-financial objectives as well as your family dynamics, to provide a holistic approach towards managing wealth across various life stages and generations. We work collaboratively with your other specialty advisors (attorneys, CPAs, insurance professionals) to coordinate, implement, and monitor your strategic wealth plan.